35+ how do you lock in a mortgage rate

Web According to the report. Protect Yourself From a Rise in Rates.

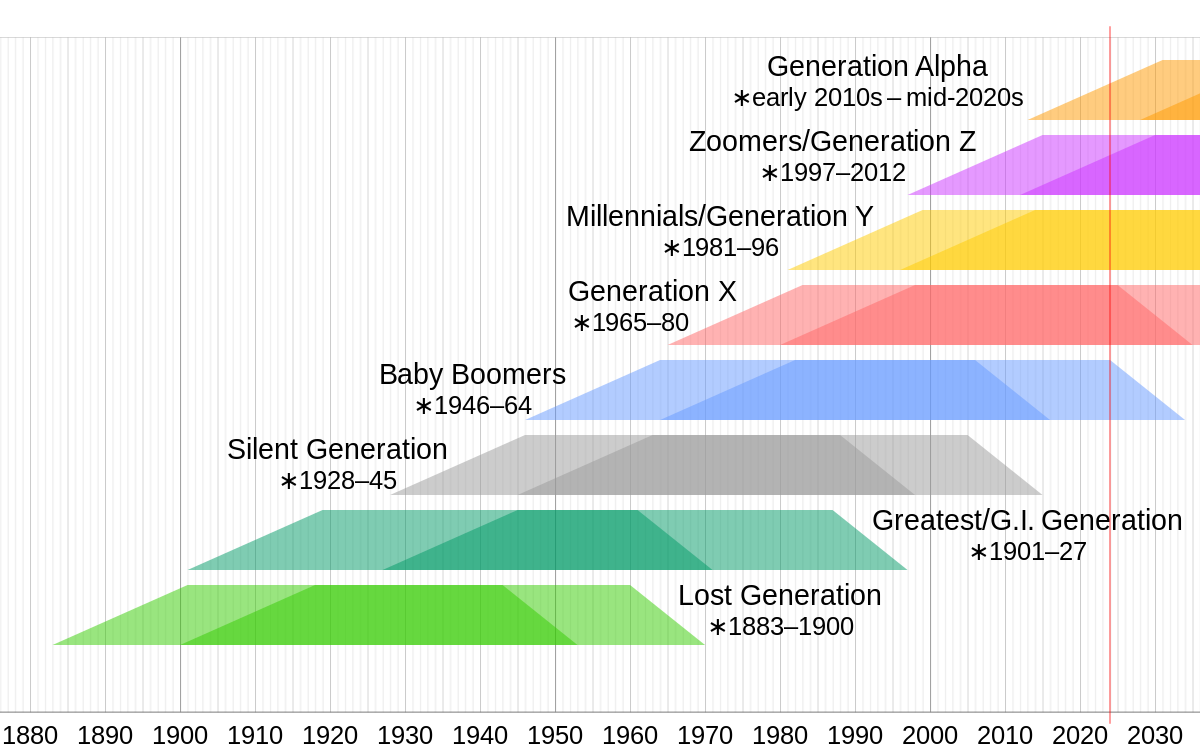

Millennials Wikipedia

With a longer rate lock period the buyers are most likely to hold on to the rate.

. Web Another rule of thumb is to lock in the mortgage interest rate for as long as possible. The lender will also ask you if you want to lock in the rate or float the rate. Overall rate lock activity fell 15 in February from January.

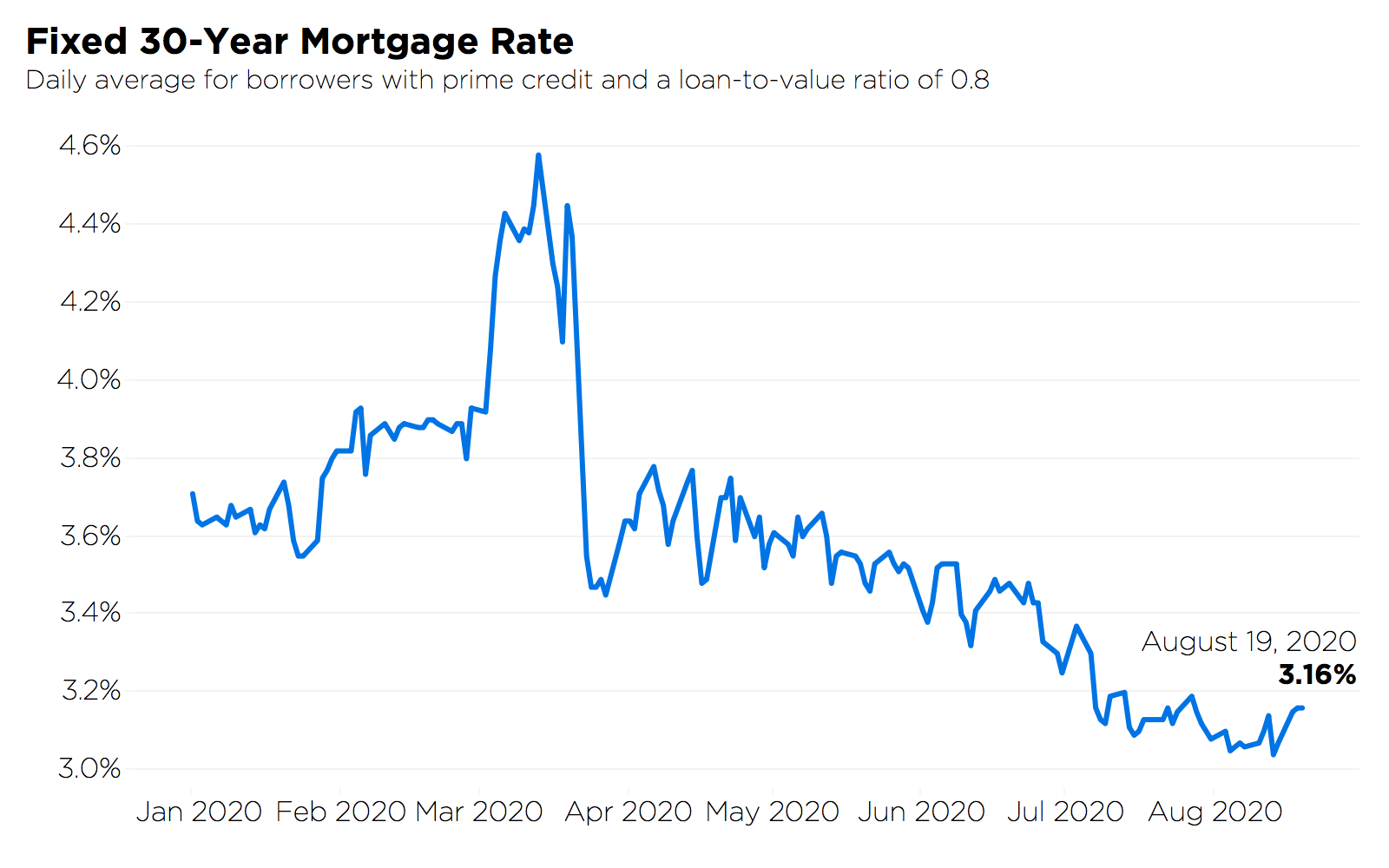

Web Most mortgage lenders offer you the option to lock in your mortgage rate after your loan application has been pre-approved. Web When you lock the interest rate youre protected from rate increases due to market conditions. Ad If You Owe Less Than 420680 Take Advantage of a Generous Mortgage Relief Program Refi.

Web A lock-in or rate lock on a mortgage loan means that your interest rate wont change between the offer and closing as long as you close within the specified. Save Time Money. Web You should lock your mortgage rate as soon as possible in the mortgage process as long as youve already shopped quotes from at least three to five lenders.

Youll want to implement the lock. If rates rise during the closing process your locked-in mortgage. Locking in early can help you get what you were.

Ad Take Advantage Of Low Rates Now - Get Started. Contact your lender before this happens to see what your options are. Protect Yourself From a Rise in Rates.

Purchase lock activity was down 13 from January. Web The primary benefit of locking in a mortgage rate is that youre protected from interest rate hikes. Web However youll usually have a 45-day window for mortgage shopping.

Web You can choose to lock in your mortgage rate from the moment you select a mortgage up to five days before closing. You could cancel your loan application and go back to square one. If rates go down prior to your loan closing and you want to take advantage of.

Web The second way to unlock your mortgage rate after a rate change is by simply jumping ship. Web A mortgage rate lock is when your lender guarantees to set your loan at a specific fixed rate even if market interest rates change before your loan closes. Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late.

Web The biggest risk of locking in your mortgage rate early is that your rate lock could expire before you close. Ad Take Advantage Of Low Rates Now - Get Started. Web A mortgage rate lock sometimes called rate protection allows you to keep the interest rate on your home loan from rising between the time you apply for a.

Get Instantly Matched With Your Ideal Mortgage Loan Lender.

Can I Unlock A Mortgage If Interest Rates Drop 2 Strategies

Mortgage Rates Are At Record Lows Here S What That Means For You Zillow Group

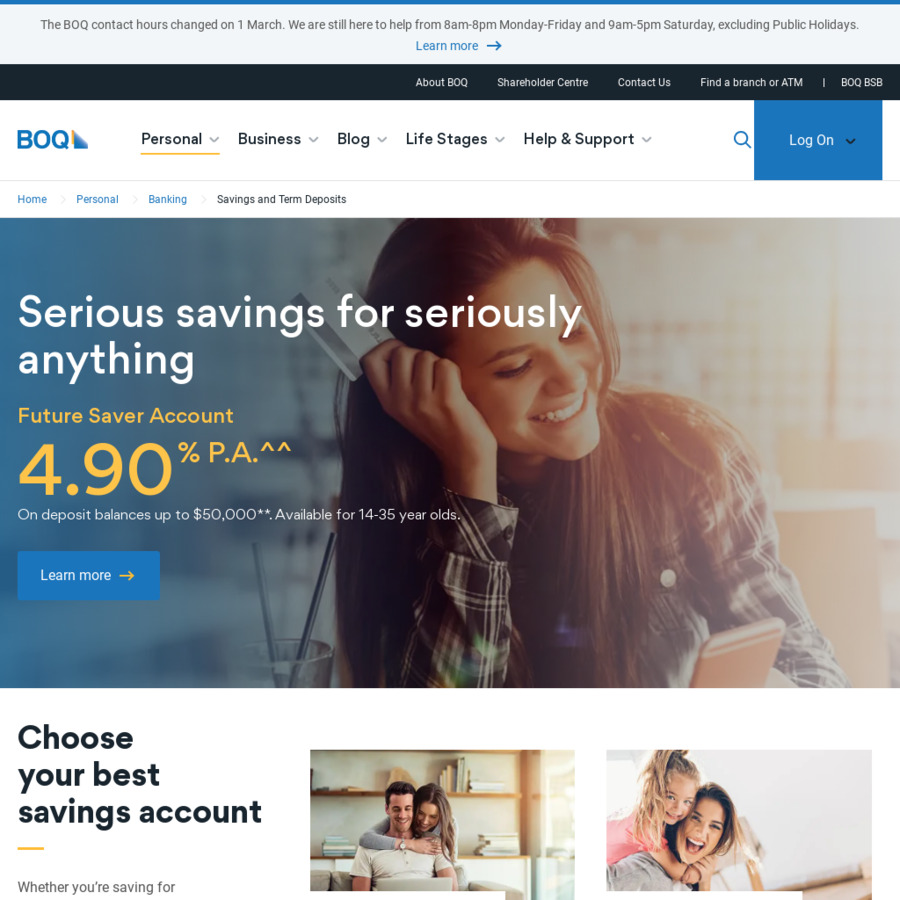

5 15 P A Interest On Balances Up To 50 000 For 14 35 Year Olds Monthly Criteria Apply For 18 Bank Of Queensland Page 2 Ozbargain

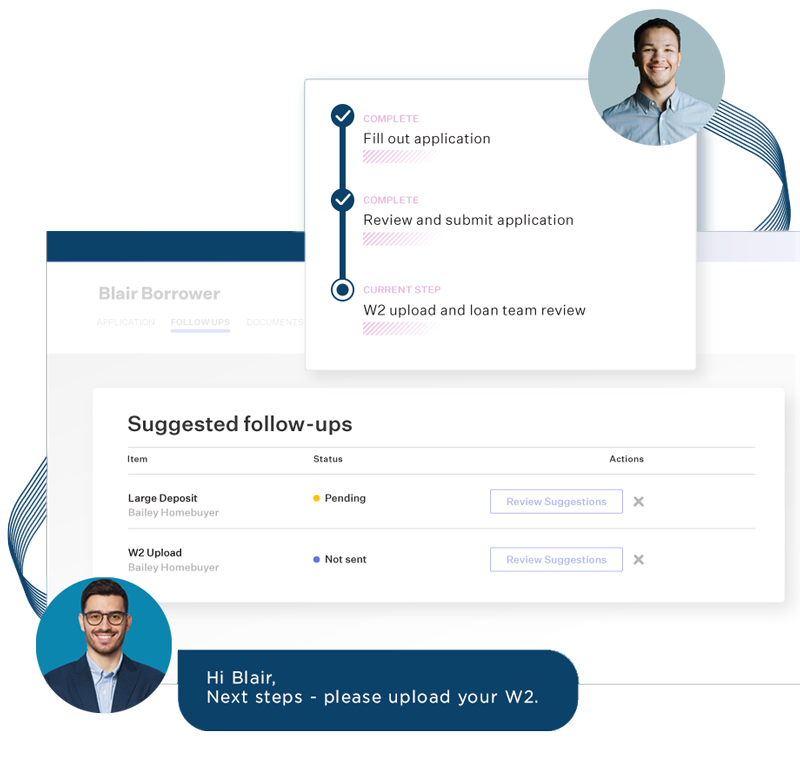

Borrow Wise Loans Sydney Nsw

Best Home Loans Mortgage Lenders Company Arizona Utah

What Your Mortgage Interest Rate Really Means Money Under 30

Can I Unlock A Mortgage If Interest Rates Drop 2 Strategies

Free 5 Sample Mortgage Commitment Letter Templates In Pdf Ms Word

How To Invest And Profit In A Rising Interest Rate Environment

Pipeline Magazine Summer 2019 By Acuma Issuu

How To Use A Mortgage Rate Lock To Secure A Low Interest Rate Fox Business

Mortgage Rate Lock How And When To Lock In Quicken Loans

Mortgage Rate And Inflation Marketing By Pizza Pizza R Canadahousing

Australian Franchise Directory 2023 By Cgb Publishing Issuu

Renewal Rate Shock Diminishing Says Boc Mortgage Rates Mortgage Broker News In Canada

Member Spotlight

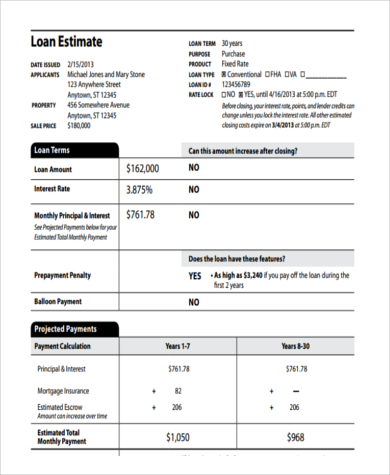

Free 7 Sample Loan Estimate Forms In Pdf Ms Word