Calculate ltv home equity loan

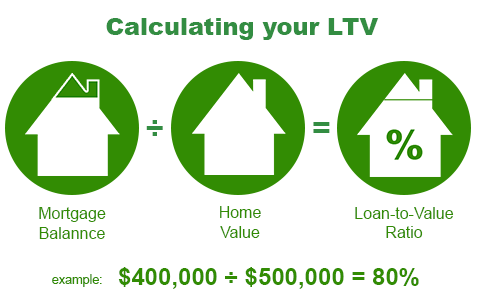

To determine how much you may be able to borrow with a home equity loan divide your mortgages outstanding balance by the current home value. LTV is based on the total debt to equity ratio for a property so if one borrows 80 of a homes value on one loan 10 of a homes value on a second mortgage.

Looking For A Heloc Calculator

Financing a home purchase.

. Calculate your mortgage payment. 2022s Best Home Equity Line of Credit Lenders Comparison. The three primary things banks look at when assessing qualification for a home equity loan are.

Apply in 5 Minutes Get the Cash You Need in Just 5 Days. The Loan-to-Value Ratio is a home equity figure that lenders use to assess risk. To accomplish this we multiply the loan to value by the value of the house.

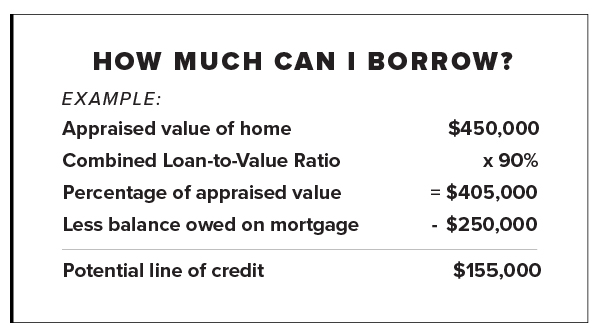

LTV Home Equity Loan Calculator This calculator will estimate how large of a credit line you may be able to qualify for for up to four lender Loan-to-Value ratios percent of value of home a. Compare Mortgage Payment Options. Then subtract your mortgage balance and any loans secured by your homelike a home equity.

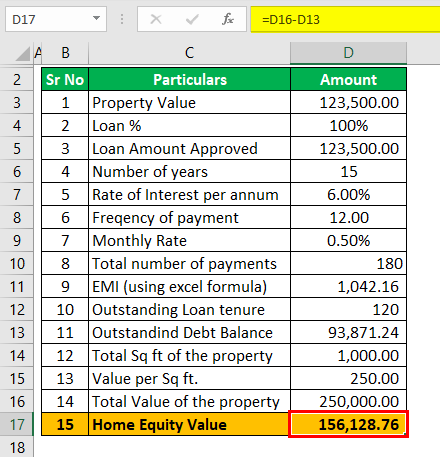

This is the annual interest rate youll pay on the loan. Using Excel to Calculate the Loan-to-Value LTV Ratio. Few lenders will let.

Home equity loan rates are between 35 and. Enter your loans interest rate. Check how much money you can borrow based on.

Home equity is the value of your ownership stake in your home calculated by subtracting your outstanding mortgage from the propertys market value. Ad Plus You Have The Option To Lock In A Fixed Rate. LTV is the reciprocal.

Ad Todays 10 Best Home Equity Line of Credit Loans. To calculate your LTV rate simply. To calculate your homes equity divide your current mortgage balance by your homes market value.

Use Your Home Equity Get a Loan With Low Interest Rates. To find out how much equity you have first get the most recent appraised value. How much house can you afford.

Ad Call to find out more. To calculate loan-to-value you simply divide your loan balance by the appraised value of your. Home equity loans typically range from 5 to 15 years.

Whether youre wondering if you have enough equity to qualify for the best rates or youre concerned that youre too far upside-down to refinance under the Home. The second use for the loan to value is to determine a maximum mortgage amount. Also check your loan-to-value ratio LTV.

To calculate your LTV ratio using Microsoft Excel for the example above first right click on columns A B and C select. Refinance Before Rates Go Up Again. Ad Call to find out more.

Flexible Borrowing Structure For Home Improvements Bill Consolidations Tuition More. 2022s Best Home Equity Loans. How to get a.

Put The Equity In Your Home To Work With A Home Equity Line Of Credit From Huntington. Ad Monthly Payment Calculations. Are you thinking about taking out a home equity loan.

HELOC Home Equity Loan Qualification. Available equity in the home. One of the ways your application is assessed is via your LTV which stands for loan-to-value ratio.

Apply Get Fast Pre Approval. Ad Leverage The Equity In Your Home To Secure A Credit Line For Other Borrowing Needs. You would calculate the maximum cash-out this way.

Ad Put Your Equity To Work. This is your LTV. Dont Wait For A Stimulus From Congress Refi Before Rates Rise.

For example if your current balance is 100000 and your homes market value is. Ad Compare All Your Equity Options in 1 Place. Ad Top 5 Best Home Equity Lenders.

The amount of equity available for a home equity loan or line of credit is determined by the loan-to-value ratio of the home. Save Time Money on Your Loan. Put Your Home Equity To Work Pay For Big Expenses.

The amount you can borrow with any home equity loan is determined by how much equity you have that is the current value of your home minus the balance owed on your mortgage. Choose the right currency if needed Input an estimate of your property value Key in the amount owed on your mortgage s Press Calculate LTV to. The calculator will estimate how much you might be able to borrow through a HELOC.

The LTC calculator provided insight into how a higher LTV percentage means that the borrower. For as many as four lender loan-to-value ratios this calculator will help you figure out the credit line you may be able to secure. You want to take the maximum equity in cash-out and the lenders maximum LTV for a cash-out is 80.

To figure out your LTV ratio divide your current loan balance you can find this number on your monthly statement or online account by your homes appraised value. It will also display your current loan-to-value LTV ratio which is a metric lenders use. Multiply by 100 to.

What Is Harp And Do I Qualify For A Harp Loan Refinance Mortgage Refinancing Mortgage Mortgage Tips

How To Calculate Equity In Your Home Nextadvisor With Time

How To Calculate Your Home Equity Finder Com

Loan To Value Ratio Ltv Formula And Example Calculation

What Is 100 Ltv Home Equity Loan How Does It Work Mortgage Refinance Company

What Is The Loan To Value Ltv Ratio For A Mortgage Freeandclear Mortgage Lenders Mortgage Process Mortgage Loans

Ltv Calculator For Mortgage Pmi Refinancing Mortgages Home Equity Loan Qualification

How To Calculate Your Loan To Value Ratio Finder Com

Loan To Value Ratio Ltv Formula And Example Calculation

What Is Loan To Home Value Omaha Ne Home Buyer S Guide Petrovich Team Home Loan

Home Equity Line Of Credit Heloc Uccu

Home Equity Loan Calculator Sale Online 53 Off Www Ingeniovirtual Com

Va Home Loan Calculator Calculate Your Payment Freeandclear Loan Calculator Loan Va Loan

Applying Is Easy Save Month Buy Vs Rent Renting Vs Homeownership Loanfi Mortgage Rent Vs Buy Jumbo Loans Mortgage

Information On 125 Ltv Home Equity Loans Mortgage Refinance Refinancing Mortgage Information Mortgage Mortg Home Equity Loan Home Equity Second Mortgage

Home Equity Line Of Credit Heloc Rocket Mortgage

Home Equity Line Of Credit Heloc Rocket Mortgage